Spain’s Innovation Surge: VC and CVC Driving Growth

Spain is no longer just a holiday destination or a logistics hub for Southern Europe. It’s becoming one of Europe’s fastest-evolving venture ecosystems, fueled by deep structural reforms, targeted public investments, and a maturing corporate venture capital (CVC) landscape that’s quietly powering innovation.

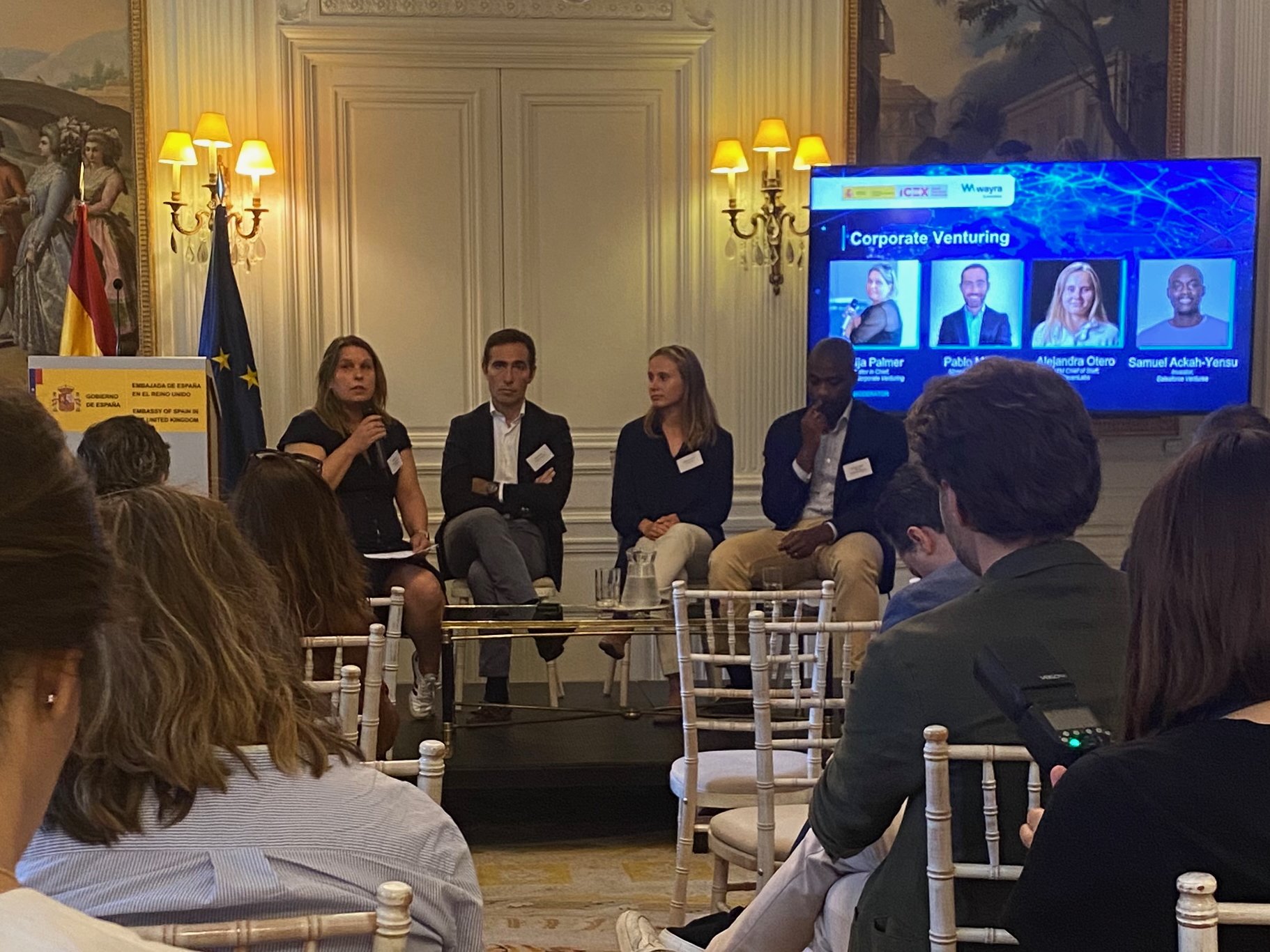

Yesterday, I attended an event at the Spanish Embassy in London, where insights were shared on UK–Spain Venture Capital: Trends and Opportunities. Investors, entrepreneurs, and advisors gathered to explore how Spain is positioning itself as a key hub for innovation and scale.

A Decade of Momentum: From Fragmented to Formidable

In just over ten years, Spain’s VC ecosystem has transformed. According to one panellist, “we’ve gone from €1.7 billion in venture funding to €14 billion, and now €22 billion in 2024.” The country has produced 17 unicorns, nurtures over 5,000 start-ups, and has created co-investment models that blend public and private capital with increasing sophistication.

The acceleration is not just in headline figures. It’s about the quality and diversity of innovation. “From neurosurgical research in the Canary Islands to sustainable aviation fuels in Barcelona, Spain’s regional ecosystems are maturing,” noted one speaker.

There’s depth in biotech, clean energy, quantum computing, and AI, often supported by EU Recovery and Resilience Facility (RRF) funds and the Spanish public sector’s investment arms such as CDTI, ENISA and ICO.

“Tourism and immigration help, but growth now depends on digitisation, clean energy and science-led innovation.”

Spanish Ambassador to the UK, His Excellency Don José Pascual Marco Martínez

What Makes Spain Competitive?

Structural Reform and Stability

Spain’s post-COVID reforms in labour law, training, and tax are paying dividends. Start-up and scale-up visa schemes have made it easier to attract global talent. Vocational training reform has helped bridge the science–industry gap.

Supportive Funding Ecosystem

The interplay between public funds (ICO, CDTI, ENISA) and an increasingly active VC and CVC market creates risk-sharing models that are attractive to early and growth-stage companies.

“Public and private funds now account for 50% of all VC activity in Spain,” said one investor. “You rarely see one without the other.”

Cost Advantage and Lifestyle Magnetism

Barcelona, Valencia, and Bilbao offer high-quality infrastructure, skilled labour and lower costs than major hubs like London or Berlin. “You can hire brilliant engineers in Valencia for half the cost of London,” one UK investor noted.

Gateway to Latin America

Spanish start-ups and corporates benefit from natural corridors into LATAM markets, thanks to language, diaspora ties, and trade flows. For UK investors, this opens up a dual-market opportunity from a single base.

Investment into the UK

The UK is Spain’s second-largest global investment destination, and Spain is among the top 10 investors in the UK, with Spanish FDI growing over 30% in early 2024.

Corporate Venturing: The Quiet Force Behind the Boom

One of the most striking insights from the event was the emergence of Corporate Venture Capital as a vital component of the Spanish innovation system.

CVC funding now accounts for around 20% of all VC in Spain, up from 5% just five years ago. When combined with public financing, corporates and public entities collectively support more than half of Spain’s venture deals.

“Corporate venturing is no longer niche. It’s central to how Spanish innovation scales. Public funds and corporates now play indistinguishable roles in accelerating tech,” said a leading Madrid-based investor.

What’s changed?

Strategic Maturity: Spanish corporates, from energy to telecoms, now view venture investing as part of long-term open innovation, not a PR exercise.

Dual Metrics: CVCs measure success through both financial performance and strategic alignment. One speaker from a global CVC described the mandate as:

“Don’t lose money. Beat the benchmarks if possible. But above all, learn faster than your competitors.”

Access to Market and Distribution: Start-ups see CVCs not just as chequebooks but as trusted distribution and product planning partners. However, some cautioned against bureaucracy:

“Corporates can’t take 60 days to approve investments when VCs move in 6,” one founder shared.

For UK investors and corporates, partnering with Spanish CVCs presents an opportunity to share risk, gain market intelligence, and access new verticals, especially in energy, healthtech, and mobility.

Deep Tech: Spain’s Investment Sweet Spot

A key theme across the panels was the strategic opportunity in deep tech, AI, biotech, quantum, and advanced materials. These sectors require patient capital, government alignment, and industrial partnerships, all of which Spain is developing at speed.

“AI might be the most epoch-defining technology of our time, but biotech like CRISPR will redefine human health and life expectancy,” said one panellist. “These aren’t short-run wins. But if you back them right, the moat is unassailable.”

Spain’s universities, particularly in Valencia, Madrid, and Seville, are producing spinouts with increasing commercial potential; however, the scale-up challenge remains.

That’s where international VCs, CVCs and ecosystem builders can make the difference, by bridging the capital, market, and mentorship gap between early-stage and global scaling.

Where Do the Opportunities Lie?

For Investors:

Late-stage venture and growth equity in under-capitalised Spanish scale-ups.

Co-investment vehicles with regional governments and Spanish corporates.

LP roles in emerging VC and CVC funds focused on Spanish deep-tech and climate ventures.

For Innovators:

Access to European and RRF-linked funding through Spanish public investment vehicles.

Lower cost of talent and operations without sacrificing access to EU customers.

Partnerships with Spanish corporates willing to back pilots and new models.

For Corporates:

Open innovation via structured CVC arms, increasingly aligned with government priorities.

Shared IP and R&D incentives through consortia funding from EU programmes.

Market expansion to LATAM through Spain-based start-ups with regional exposure.

A Note on Mindset and Market Entry

One piece of advice echoed throughout the event: presence matters.

“To invest in Spain, or anywhere, you need boots on the ground. You need to spend time in the market, in person,” said a UK-based founder now operating across Madrid and London.

Delegations, co-working residencies, and dual-hub structures are increasingly common. Whether for scouting investment opportunities or embedding talent, Spain rewards visibility and collaboration.

Final Thought: Don’t Miss the Inflection Point

Spain is no longer a peripheral player in European innovation. It is becoming a core part of the EU’s growth engine, particularly as the region retools its industrial base, advances clean energy, and expands digital sovereignty.

For investors seeking to deploy capital beyond traditional destinations, and for corporates looking to establish R&D pipelines and growth partnerships, Spain offers both value and velocity.

“We’re not just catching up. We’re shaping the next wave of European innovation,” said one closing panellist.

Judging by the quality of insight and ambition at this event, it’s hard to disagree. And not just that, but it is also how they deploy that capital in overseas opportunities.

If you’d like to explore investment opportunities in Spain, or how CVCs and strategic communications can unlock value across borders, connect with me here on LinkedIn.