Trust Is Currency: Why Reputation Drives Tech Investment

In today's startup ecosystem, especially in tech, founders and investors operate in a world where trust isn't a soft virtue; it's a strategic asset. For venture capital (VCs), corporate venture capital arms (CVCs), and family offices (FOs), reputation increasingly dictates who gets funded, how fast deals close, and whether a relationship survives public scrutiny. And of course, if a pre-IPO company or start-up is looking for a buy-out or an exit in the long term, reputation and how they and their management are perceived is critical in how they get valued during future funding rounds.

With more than 32,000 active venture capital firms, 8,000 corporate venture capital units, and 10,000 single-family offices worldwide, and institutional investors increasingly seeking safer opportunities, perception has effectively become reality.

Startups looking for funding in 2025 face a high-stakes environment. Institutional investors are more selective. Reputation has moved from a nice-to-have to a non-negotiable filter. In a market where digital footprints and public narratives shape due diligence as much as financials, tech leaders and investors must treat reputation as core infrastructure.

The Financial Value of Reputation

How your brand, product, or service is perceived is your reputation, and your reputation is an intangible asset.

In 2020, research from Lloyds of London and KPMG found that ‘corporate brand and reputation accounts for 25.3% of the market capitalisation of the world’s leading equity market indices, equating to $16.77 trillion of value for shareholders in Q1 2019.’ At the start of 2024 reputation accounted for 30% of FTSE 350 companies’ market capitalisation, equating to £719 billion. This marks a 3.8% increase from the previous year, according to Echo Research.

The value and contribution of reputation to the valuation of a company is not equal. The importance of brand and reputation changes depending on the industry. In fast-growing sectors like technology, reputation can make up a big part of a company’s value, up to 43%. In slower-moving and more established industries like utilities, it still accounts for up to 25%, confirming how companies in industries focused on innovation, how a company is perceived really affects its success.

Understanding the Key Investors: VC, CVC, and Family Offices

How VCs Operate and Why Reputation Matters

Venture capital firms raise closed-end funds, typically lasting 10 years, and target internal rates of return (IRR) in the range of 20–30%. These firms compete aggressively to lead rounds, seeking both strategic influence and governance rights. In Q1 2025, VC deal activity totaled 3,990 U.S. deals worth $91.5 billion, an 18.5% increase in value from the previous quarter—the highest since early 2022. However, the market remains selective: only 892 of these were first-time financings, a continued decline from prior years. Notably, AI companies received 71% of all VC capital, signaling a strong flight to quality .

From the first meeting to investment committee approval, reputation is increasingly a critical filter. Startups demonstrating strong governance, transparency, and credible leadership are more likely to secure funding in this cautious yet capital-rich environment.

The Strategic Lens of Corporate Venture Capital

Corporate venture capital (CVC) arms invest corporate funds to gain insights into emerging technologies, markets, and potential acquisition targets. While they often take minority stakes (typically 10–25%), they prioritize alignment with the parent company’s values and brand.

According to Silicon Valley Bank’s 2024 State of Corporate Venture Capital report, CVCs participated in 28% of global venture capital deals, reflecting their significant role in the innovation economy. Notably, 80% of surveyed CVCs listed “brand fit” and “reputational alignment” as essential criteria for investment decisions.

Meanwhile, Global Corporate Venturing’s the World of Corporate Venturing 2025 report notes that over 65% of CVCs now integrate ESG metrics into investment decisions from the outset, and a growing number are embedding reputational due diligence into standard deal workflows. It also highlights that sectors such as AI, climate tech, and digital health have seen an uptick in CVC activity precisely because the reputational alignment with future-forward innovation has become a competitive differentiator.

Reputational due diligence is no longer a post-deal PR consideration, but a critical component of strategic value creation and risk management, with corporate risk or communications teams often holding veto power over deals that pose reputational threats.

Family Offices and the Reputational Stakes of Legacy Capital

Family offices represent generational wealth and place immense value on brand integrity. Citi Private Bank reports that 69% of family offices now make direct venture investments, with average deal sizes of $24 million. Yet 74% of them cite “preserving the family name” as a top priority.

Their reputational bar is high. Scandals, such as Singapore’s $3B seizure of FO-linked assets in 2023, demonstrate how fast trust can unravel. Most family offices operate without formal governance frameworks, further increasing the impact of reputational damage, but that is changing.

Single or Multi-Family Offices expect privacy and discretion. They often limit information online, preferring trusted human gatekeepers and portfolio managers to maintain confidentiality, which is why private strategic advisory and communications are for many slowly becoming a must-have, especially when they make investments in innovation that can create returns.

The ROI of Trust: Financial Value of Reputation

Trust Premiums and Risk Discounts

Edelman’s 2025 Trust Barometer shows that businesses are the most trusted institutions globally, but that trust is conditional and is only loaned to businesses by the public who shape their perception of each company depending on their values and the experience they themselves get. Reputation reduces information asymmetry, a known barrier in venture deals. Research shows that companies with strong reputations enjoy up to 10% lower capital costs and better IPO outcomes.

Echo Research found that reputation adds pricing power. Meanwhile, the NVCA tracked that startups with a positive reputation close Series A rounds up to 9 months faster.

VCs Use Reputation to Make Faster, Better Bets

When markets cool, investors get more selective. Academic studies in 2024 found that founder reputation weighed 25% more heavily in VC decision-making in colder funding environments. Founders with strong digital footprints not only raise faster, they also fail less. Personality traits like conscientiousness correlate with a 30% lower startup failure rate.

Reputation Risk in the Public Spotlight: CVC and FO Realities

CVCs have unique vulnerabilities. They’re exposed to public markets. Forty-one percent of CVCs left deals in 2023 due to concerns about founder conduct. A bad founder headline can knock more off the parent company's stock price than the entire investment value.

For family offices, reputational risks hit home, literally. Without diversified shareholder bases, any issue reflects directly on the family name. Consequently, jurisdictions are tightening Know-Your-Client rules, and background checks are getting deeper and more global.

Data That Proves Reputation Moves Capital

The numbers speak volumes. A strong reputation isn’t just nice optics, it accelerates fundraising and improves pricing.

Actionable Strategies for Founders

For Founders Targeting VCs

Own your digital presence: Start with search engines. Secure your domain, polish your LinkedIn, and ensure expert third-party references validate your story.

Signal governance early: Add an experienced advisor or board member—investors see this as a sign of maturity.

Transparency is credibility: Clearly address regulatory, IP, or ESG risks in your pitch. Founders who proactively surface challenges earn trust.

System beats heroics: VCs increasingly back methodical execution over lone-wolf brilliance. Show process, not just passion.

For Founders Navigating CVC Deals

Anticipate brand alignment issues: Show you understand how your startup affects the parent company’s image, customers, or supply chain.

Plan communications in advance: CVCs often want veto power on public statements. Agree on messaging protocols early.

Culture matters: Ensure ethical compatibility. Many CVCs have walked away after realising values misaligned late in diligence.

For Founders Pitching Family Offices

Highlight mission fit: Make it personal. Show how your goals reflect the family’s values and legacy.

Assure privacy and control: Emphasise discretion and reporting transparency. Many FOs avoid the press and need assurance.

Prepare for deep diligence: Be ready for private investigators, detailed social media audits, and extensive reference checks.

Tools for Investors to Manage Reputational Exposure

For All Investors

Use real-time sentiment tools: Platforms like Aon show that social sentiment can flag risks up to 48 hours before mainstream media.

Test your ESG narrative: Regulators and the public scrutinise climate-related statements—integrity here builds trust.

Check founder resilience: Prior failure isn’t disqualifying, unless it's undocumented or unaccountable. Resilient storytelling matters, and keep close to your narrative.

For CVC Committees

Ask for reverse diligence: Let founders evaluate you. It helps identify cultural fit and increases mutual trust.

Model reputational downside: Weigh how a founder scandal could affect the parent stock price versus deal value.

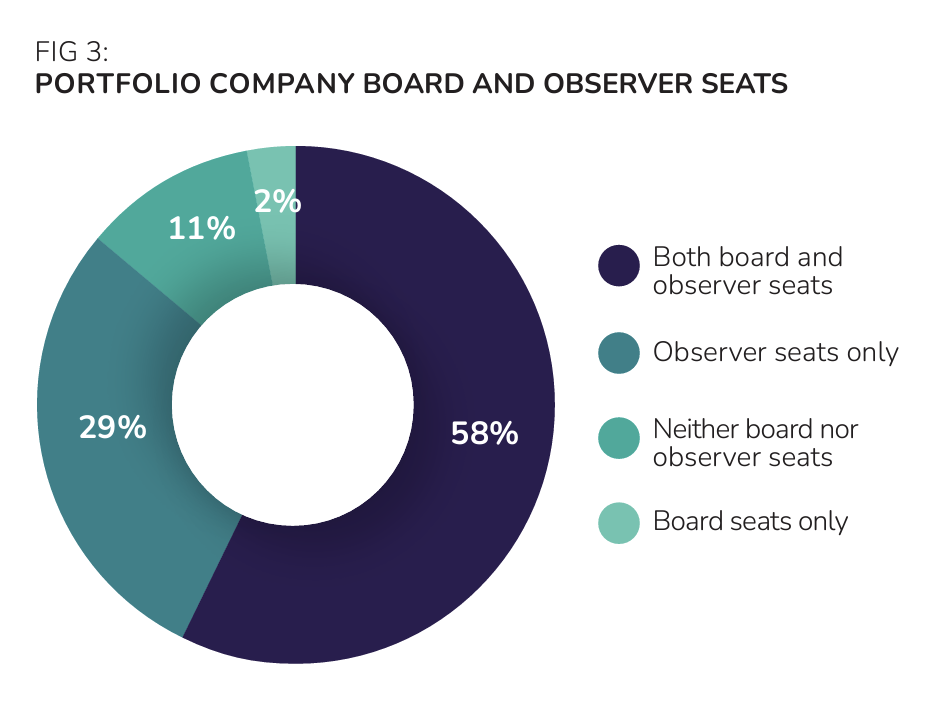

Use observer seats first: Until startups meet milestones, keep influence without full exposure.

For Family Offices

Formalise succession and oversight: Only 47% of FOs have succession plans. Reputational crises can escalate without clear leadership.

Cross-check due diligence: Supplement commercial vetting with journalistic or NGO insights.

Pre-invest in buffers: Crisis communications and insurance may feel optional—until you need them.

Reputation Is Capital

Across venture capital, corporate venture, and family offices, the mechanics of investing may be different, but one principle holds: reputation, perception, and trust moves money. Managing perception is now a financial must-have in an age where every stakeholder can broadcast their judgment instantly. For many, what you are asking for and negotiating privately, you want to remain private.

Founders who prioritise transparency, governance, and integrity don’t just earn trust, they compound it. Investors who integrate real-time data and stress-test for narrative risk will gain a competitive edge.

In 2025 the most influential backer may not sit on your cap table. It may be the online consensus shaping every deal. Respect it, earn it, and capital will follow.

Privately or publicly, reputation matters.

For VCs, CVCs, and family offices, reputation is no longer a soft metric, it is a strategic asset. I advise investors and their portfolio companies on how to strengthen governance, how to position themselves and sharpen messaging, and build resilient reputational capital that supports long-term value creation and stakeholder trust.

If you’re seeking to enhance the strategic positioning of your investments or reduce reputational risk, I would welcome a conversation.

To stay informed, subscribe to my LinkedIn newsletter, Reputation Matters, where I share insight and practical guidance at the intersection of investment, innovation, and trust.

Please feel free to connect or share this with your nrtwork who may benefit. to my LinkedIn Reputation Matters newsletter. Or connect with me on LinkedIn.